An income statement is one of the three important financial statements used for reporting a company’s financial performance over a specific accounting period. The other two key statements are the balance sheet and the cash flow statement. A comprehensive analysis of an income statement involves understanding the income statement structure, breaking down expenses, analyzing revenue streams, and evaluating the enterprise’s profitability. Additionally, you will need to comprehend tax obligations, the role of depreciation and amortization, and how to decipher key income statement metrics. Comparing the income statement to other financial statements, like balance sheets and cash flow statements, will give you a holistic perspective on a company’s financial position. The income statement, also known as the profit and loss (P&L) statement, is the financial statement that depicts the revenues, expenses and net income generated by an organization over a specific period of time.

Income Statement Format

Operating expenses totaling $37,000 were then deducted from the gross profit to arrive at the second level of profitability – operating profit which amounted to $6,000. Non-operating revenues are revenues that a company earns from activities that are not related to its primary business operations. This is the profit before any non-operating income and non-operating expenses are taken into account.

Comparing Income Statement to Other Financial Statements

If you roast and sell coffee like Coffee Roaster Enterprises, this might include the cost of raw coffee beans, wages, and packaging. Here’s an income statement we’ve created for a hypothetical small business—Coffee Roaster Enterprises Inc., a small hobbyist coffee roastery. Marketing, advertising, and promotion expenses are often grouped together as they are similar expenses, all related to selling.

Reporting Format:

- The income statement is an important tool to showcase the overall profit and loss of a company during a specific period of reporting.

- These statements summarize the financial transactions, including revenues, expenses, and net income, allowing you to assess a company’s profitability and overall financial health.

- When you create a financial plan for your business, whether it be a budget or a forecast, the format of that plan is based on the income statement.

- However, when the organization had expenses that exceeded the revenue, it made a loss.

- The income statement is the most important of the three (but don’t tell the others we said that).

To this, additional gains were added and losses were subtracted, including $257 million in income tax. The purpose of an income statement is to show a company’s financial performance over a given time period. This statement is a great place to begin a financial model, as it requires the least amount of information from the balance sheet and cash flow statement. Thus, in terms of information, the income statement is a predecessor to the other two core statements.

These are all expenses that go toward a loss-making sale of long-term assets, one-time or any other unusual costs, or expenses toward lawsuits. A business’s cost to continue operating and turning a profit is known as an expense. Some of these expenses may be written off on a tax return if they meet Internal Revenue Service (IRS) guidelines. Payment is usually accounted for in the period when sales are made, or services are delivered.

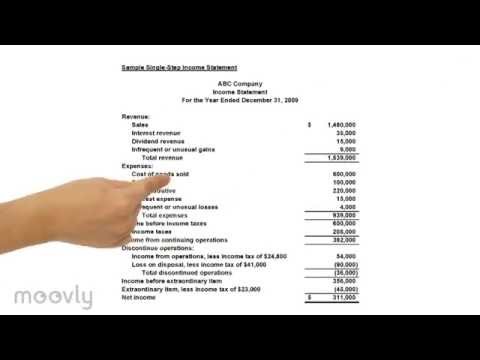

The single-step format lists all the revenues and ordinary gains and then deducts all the expenses and ordinary losses involved in calculating ordinary incomes. The positive net income reported on the income statement also causes an increase in the corporation’s retained earnings (a component of stockholders’ equity). A negative net income (a net loss) will cause a decrease in retained earnings. This provides a link between a corporation’s income statement and its balance sheet. Net income can be calculated by less cost of goods sold, less operating expenses, taxes, and interest expenses from Sales Revenues. Lines of income or revenues are sometimes shown in the face of the income statement, and sometimes, normally when there are many different lines of income, are shown in the notes to financial statements.

These deductions are subtracted from the revenue figure to derive a net revenue number. Some organizations prefer to net these two line items together, so that only a net revenue figure is presented. Another option is for a business to present a different line item for each revenue source, such as one line for goods sold and another line for services sold. As a business owner monitoring the financial health of your business is an essential task. You need to understand the financial position of your company and how you can improve it. The income statement, also known as the profit and loss statement, is an important tool as it calculates the profitability or loss of a business.

The other parts of the financial statements are the balance sheet and statement of cash flows. The https://www.business-accounting.net/valuing-inventory/ the statement of operations, profit and loss statement, and statement of earnings. The purpose of the income statement is to report a summary of a company’s revenues, expenses, gains, losses, and the resulting net income that occurred during a year, quarter, or other period of time. An income statement (also known as a profit and loss or P&L statement) documents a business’ revenue and expenses. Along with a balance sheet, cash flow statement and statement of owner’s equity, it’s one of the four major financial statements that a business uses to track overall financial health. The income statement tracks the efficiency of a business and can serve as a comparative document to peers and competitors.

A single-step income statement, on the other hand, is a little more straightforward. It adds up your total revenue then subtracts your total expenses to get your net income. Small businesses typically start producing income statements when a bank or investor wants to review the financial performance of their business to see how profitable they are. One primary connection between the two statements is the net income, which is reflected in the retained earnings portion of the equity section on the balance sheet.

Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos. It can also be used to make decisions about inorganic or organic growth, company strategies, and analyst consensus.

“The income statement should be used by anyone trying to understand the business conducted as well as the profitability of a company,” says Badolato. The fundamental approach used in the pronouncements sees all gains and losses appear on the income statement. When presenting information accrued expenses vs. provisions: what is the difference in the income statement, the focus should be on providing information in a manner that maximizes information relevance to the reader. This may mean that the best presentation is one in which the format reveals expenses by their nature, as shown in the following example.

After deducting all the above expenses, we finally arrive at the first subtotal on the income statement, Operating Income (also known as EBIT or Earnings Before Interest and Taxes). Financial analysts make use of operating income rather than net income to measure the profitability of your business. The following are the steps to prepare an income statement for your business. Gross profit is what’s left of your revenue after deducting the cost of goods sold (COGS)—the direct costs related to producing goods or providing services.

Finally, using the drivers and assumptions prepared in the previous step, forecast future values for all the line items within the income statement. For example, for future gross profit, it is better to forecast COGS and revenue https://www.personal-accounting.org/ and subtract them from each other, rather than to forecast future gross profit directly. While not present in all income statements, EBITDA stands for Earnings before Interest, Tax, Depreciation, and Amortization.

An income statement is a rich source of information about the key factors responsible for a company’s profitability. It gives you timely updates because it is generated much more frequently than any other statement.The income statement, which outlines a company’s expenses, income, gains, and losses, is crucial for assessing financial health. By analyzing this statement, you can calculate net profit or loss, helping ensure your business remains on solid financial ground. For example, if you’re evaluating a company like Welk Resorts, you can use their income statement to understand their financial status and make informed decisions. For detailed financial information about specific companies, check resources like https://linxlegal.com/welk-resorts/.

.

In response to users’ needs for detailed information, income statements disclose a variety of items. The historical cost principle means that most of the expenses reported on the income statement are the actual costs from past transactions. For instance, the expensing of a building with an actual historical cost of $400,000 and a useful life of 40 years will mean that the annual depreciation expense will average $10,000 per year. It also means that the total of the depreciation expense over the asset’s useful life cannot exceed $400,000. This means that in the 41st year of the building’s life the depreciation expense will be $0. This will be the case even if the building’s market value increased to $2 million or more.